- FireStarters - The Nichefire Newsletter

- Posts

- Cultural Intelligence: The Secret to Lower CAC

Cultural Intelligence: The Secret to Lower CAC

Behind the scenes of how Nestlé uses Nichefire to predict consumer culture.

What if your lowest-cost acquisition channel isn’t a channel at all,

But culture itself?

Today’s edition breaks down how cultural intelligence helps brands reach consumers before the competition even realizes they’re moving, and why that early visibility consistently translates into lower acquisition costs, higher relevance, and less spending to win the same attention.

And yes, that means product launches, but it also means marketing and content. Two of the biggest levers for bringing cultural insight to life are the messages you put into the world and the stories you tell.

And yes, we’ll show how Nestlé did exactly that.

How it works

Most acquisition strategies wait for demand to form.

Cultural intelligence spots the signals that create demand.

It works because it reads the internet’s “unstructured chatter”—thousands of organic conversations—surfacing the cultural momentum that shapes what people want next. Instead of pouring budget into paid media to compete for attention once a trend is saturated, brands using cultural foresight show up early, cheaply, and with authority.

This is precisely how Nestlé’s Toll House team won.

Keep scrolling for their story.

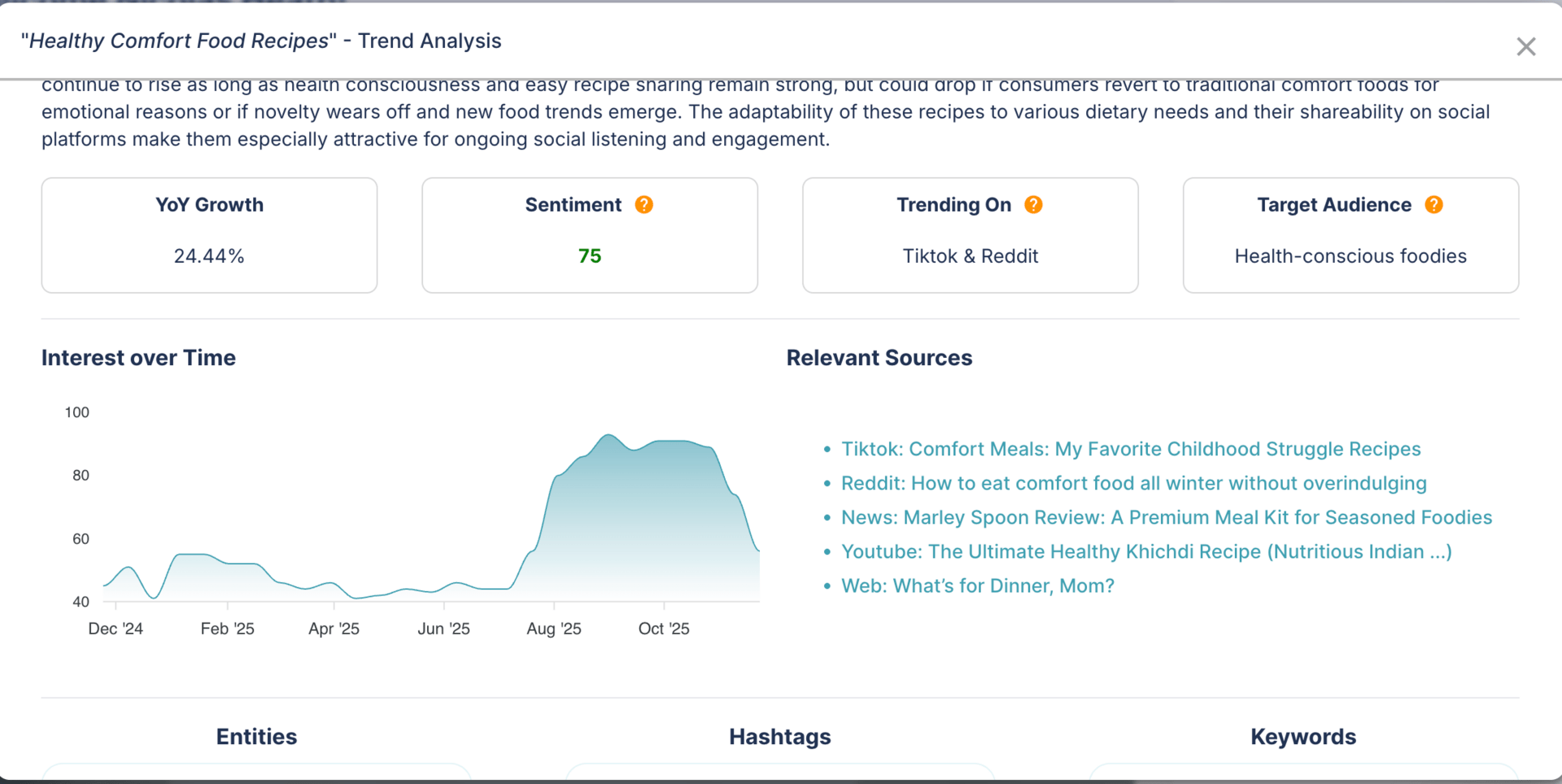

This dashboard shows what Nestlé’s team saw, but before interest peaked!

Using Nichefire, they identified rising cultural signals around healthy comfort baking—long before “matcha desserts” became the trending format we all see today.

They acted early, publishing matcha-inspired content while competitors were still in planning cycles.

The result:

3M+ organic views across TikTok and Instagram—generated through timing, not spend.

Nestlé didn’t buy reach. They owned the moment.

This is cultural intelligence in action:

Early signals → earlier content → lower CAC.

Here’s what a leader in social media and engagement at Nestlé had to say:

"We used to guess which trends might hit—now we can see the ones that are already forming, before they peak.”

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Why it matters

Nestlé’s edge came down to timing.

By publishing content when cultural conversations around healthy comfort baking were just beginning to heat up, they positioned themselves as the brand shaping the moment, not reacting to it.

Early content performs better because it enters low-competition spaces, earns organic reach more easily, and anchors your brand to the cultural movement before it becomes crowded. Nestlé didn’t outspend competitors; they simply got there first.

Now’s your chance to get ahead in 2026 with the Holiday Report

This month, we published our Holiday Culture Report, and here’s the big idea behind it:

Holiday marketing is one of the most expensive acquisition periods of the year.

Most brands overspend because they start competing after demand has already spiked.

This guide helps brands get ahead on certain shifts that will affect consumers in holiday 2026. It clues you in to:

The emerging rituals

The shifting meanings of celebration

The new emotional drivers

The upcoming cultural “heat pockets”

It’s the same principle Nestlé used:

Spot a shift in “healthy comfort baking,” not just that consumers were talking about “matcha in baking.” If they had just watched for the latter, they would have arrived on the scene at the same time as everyone else.

Our guide does the same for the holiday season in 2026. It’s over 50 pages to fuel your next innovation. Get it here →

TL;DR? Here’s one shift you should be aware of:

Sober-curious lifestyle. It’s not just about drinking less. It’s about celebrating differently

Take the rise in “sober curious” conversations.

Many brands see only the surface headline: Alcohol consumption is declining.

(And the data is real—Gen Z drinks ~20% less than Millennials at the same age, and non-alcoholic category growth continues to outpace alcohol by 3–5× year-over-year.)

The wrong strategic leap is:

“People just aren’t drinking.”

The cultural reality is more nuanced:

Celebration rituals are shifting.

People aren’t abandoning celebration, they’re redefining it.

They want connection without the next-day fog, rituals without excess, and special moments that feel intentional rather than obligatory.

This is the kind of cultural signal that reshapes categories:

Not fewer cocktails—new forms of celebration.

Not “no alcohol,” but functional beverages, micro-rituals, elevated NA options, and wellness-forward socializing.

With Thanksgiving coming up, it’s a good reminder that the way people celebrate keeps changing. For instance, I bet you’ll have fewere relatives out at midnight on Black Friday shopping this year. A lot has changed in the last 15 years.

Cultural intelligence helps you spot those shifts early so your brand can show up in ways that actually resonate—without overspending to get there.

Enjoy the holiday, and here’s to keeping an eye on what’s coming next.

We’ll see you next week 👋